- Joined

- Nov 3, 2024

- Messages

- 109

- Reaction score

- 1

- Points

- 18

Supply and Demand Zones in Forex Trading MT4

Supply and demand zones are among the first concepts a beginner forex trader learns. These zones are crucial because prices often react to them even years after they were first established. With a supply and demand zones indicator, a trader no longer has to worry about manually drawing these historical zones over and over again.

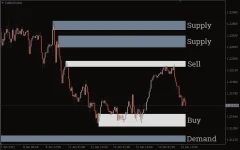

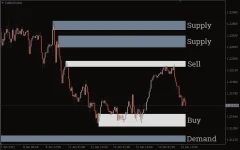

Typically, the price will hit a supply zone and then bounce back down, while hitting a demand zone causes it to bounce up. Traders can use this predictability to make strategic trades: the general rule is to sell at supply zones and buy at demand zones.

Additionally, it is best to rely on retested zones, shown in white, as these are more reliable. White zones have been tested by price at least twice, whereas grey zones are ideal for observing potential areas that may become reliable over time.

Supply and demand zones are among the first concepts a beginner forex trader learns. These zones are crucial because prices often react to them even years after they were first established. With a supply and demand zones indicator, a trader no longer has to worry about manually drawing these historical zones over and over again.

The Supply and Demand Zones Indicator for MT4

This supply and demand zone indicator automatically draws the supply and demand zones for any currency pair on the chart. On the MT4 platform, these zones are displayed in two colors: white and grey. White zones represent areas that have been retested recently, while grey zones indicate untouched areas. In the indicator settings, traders can adjust it to show Fibonacci retracement levels between zones.How to Use the Supply and Demand Zones Indicator

Using the supply and demand zone indicator is straightforward. Since supply and demand zones function similarly to support and resistance zones, traders can apply the indicator similarly.Typically, the price will hit a supply zone and then bounce back down, while hitting a demand zone causes it to bounce up. Traders can use this predictability to make strategic trades: the general rule is to sell at supply zones and buy at demand zones.

Additionally, it is best to rely on retested zones, shown in white, as these are more reliable. White zones have been tested by price at least twice, whereas grey zones are ideal for observing potential areas that may become reliable over time.

Who Benefits Most from the Supply and Demand Zone Indicator?

This indicator is beneficial for all forex traders. Beginners who have difficulty identifying support and resistance levels may find it particularly helpful. Professional traders who prefer drawing their own zones might not rely on it as much, but its accuracy makes it a valuable tool for anyone who uses supply and demand concepts in their trading strategy.Key Facts about Supply and Demand Zones

Construction:- Demand Zones: Formed where prices rise sharply, indicating strong buying interest. When revisited, these zones often prompt further buying.

- Supply Zones: Created where prices drop sharply, signaling strong selling pressure. Sellers tend to react when prices return to these zones.

- Fresh Zones: Newly formed and untested, considered strong due to unfulfilled orders.

- Tested Zones: These have already been touched by the price; while still significant, they may weaken with time.

Differences from Support and Resistance Levels

- Supply and Demand Zones: Cover wider price ranges and are based on volume and market movements, making them more relevant for long-term strategies.

- Support and Resistance Levels: Represent specific price points, usually identified by previous price touches, and are generally more suited for short-term trading.

Pros and Cons

Pros:- Accuracy: Provides reliable entry and exit points based on real market behavior.

- Longevity: Remains relevant over time, aiding in long-term trade planning.

- Complexity: Harder to identify without using indicators.

- Uncertainty: The broadness of zones can make precise entry timing challenging.