- Joined

- Nov 2, 2024

- Messages

- 144

- Reaction score

- 6

- Points

- 18

How the ARBITRAGE Technique Works

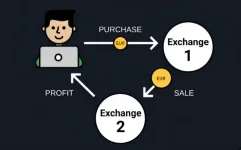

For those experienced in Forex trading, you may have noticed that prices for the same financial instrument can vary noticeably between brokers, especially during periods of high volatility, significant news events, or even in quieter market conditions. Eventually, these price differences tend to converge across brokers, but the initial discrepancies create valuable trading opportunities.

Download Arbitrage EA

Why Do Price Discrepancies Occur?

This difference in pricing often comes down to liquidity providers. Each broker has its own liquidity provider, which can lead to slight differences, or "hovering," in quoted prices.Additionally, the MT4 platform’s system for transmitting quotes isn’t always perfect. Brokers use a "Bridge" to connect with their liquidity providers, which sometimes results in slight delays in quote transmission. Although these delays are very brief, they aren’t easily noticeable to the human eye and aren’t feasible for manual trading.

This is where an automated trading robot becomes highly valuable in capturing these brief opportunities.

How Arbitrage Opportunities Can Be Profitable

Arbitrage opportunities in Forex trading are essentially low-risk positions that allow for larger lot sizes with smaller stop losses, which can lead to impressive profit margins.For this reason, certain Arbitrage Robots claim profits of 100-500% within a few days, though this approach also involves higher transaction risks. Brokers, however, are often cautious about high-frequency trading techniques and may attempt to restrict them, as the profits typically come directly from the broker’s own funds.

The Core Advantage of Arbitrage Robots

In simple terms, the Arbitrage technique enables trading robots to exploit the tiny time lag in brokers’ systems, essentially "seeing into the future" by fractions of a second.This small but crucial advantage allows the robot to make quick, profitable trades that would be challenging to execute manually.

Last edited: