- Joined

- Nov 2, 2024

- Messages

- 144

- Reaction score

- 5

- Points

- 18

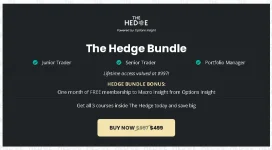

SpotGamma Academy - Options Trading Courses

SpotGamma Academy offers a comprehensive set of courses designed for traders at various stages in their career, from junior traders to portfolio managers.The academy's courses focus on advanced options strategies, risk management, and market dynamics. By leveraging options pricing models, Greeks, and volatility analysis, SpotGamma helps traders understand and master the complexities of the options market.

Courses Overview

1. Junior Trader

Junior traders are introduced to the fundamental concepts of options trading. The course focuses on understanding the basic principles behind option premiums and how they behave in different market conditions.Key Learning Outcomes:

- Analyze Option Profit Profiles: Learn how to read and interpret the profit profiles for call and put options.

- Understand Option Pricing: Learn about the variables that determine an option’s price, including intrinsic value and time value.

- Option Chain Analysis: Gain the ability to read and compare option chains, and evaluate the pricing of different strikes and maturities.

2. Senior Trader

Senior traders focus on converting trading ideas into actionable positions, quantifying risk-reward, and analyzing the effects of the Greeks on options positions. This course dives deeper into market dynamics and the role of volatility.Key Learning Outcomes:

- Evaluate the Greeks: Understand the various Greeks (Delta, Gamma, Theta, Vega, etc.) and their impact on risk management.

- Market Makers and Delta Hedging: Learn how market makers influence stock price movements through Delta hedging.

- Volatility Analysis: Understand the difference between realized and implied volatility, and how each impacts options pricing.

- Multi-Dimensional Scenarios: Use advanced modeling techniques to project the path of an option’s value based on changes in price, time, and volatility.

3. Portfolio Manager

Portfolio managers refine their skills in generating original ideas, optimizing trades, and managing risk across large portfolios. This course emphasizes advanced volatility strategies, skew analysis, and second-order Greeks.Key Learning Outcomes:

- Term Structure Interpretation: Learn to analyze and interpret the shape of the term structure for options.

- Forward Implied Volatility & VIX Futures: Understand the concept of forward implied volatility and its application to VIX futures.

- Volatility Skew and Tail Risk: Learn how to assess and interpret volatility skew, and how it can inform you about potential tail risks in assets.

- Advanced Greeks: Study second-order Greeks like Vanna and Charm, and understand their influence on the market due to dealer positioning.

- Advanced Trading Strategies: Learn and implement complex options strategies such as spreads, ratios, butterflies, and volatility trades.

- Gamma Squeeze Trading: Identify and trade gamma squeezes, both before and after they occur.

Course Summary

SpotGamma Academy provides a progressive learning path for traders, starting with basic options knowledge and advancing to sophisticated portfolio management strategies.Whether you are just starting out as a Junior Trader or aiming to optimize your strategies as a Portfolio Manager, the academy's curriculum offers practical, actionable insights to refine your skills.

Through understanding the Greeks, volatility, and order flow, SpotGamma equips traders with the tools needed to manage risk and seize opportunities in the options market.

Sales Page:

Price: $499.00

FREE Download :