- Joined

- Nov 3, 2024

- Messages

- 109

- Reaction score

- 1

- Points

- 16

ATR Trailing Stop Indicator for MT4

Successful forex traders excel at setting stop losses at optimal levels. Among the tools available, the ATR Trailing Stop Indicator for MT4 stands out as it leverages the Average True Range (ATR) to calculate market volatility and determine the most effective trailing stop loss.

This indicator helps traders manage their positions by providing insights into market trends, volatility, and ideal entry and exit points. Thanks to its precision, the ATR-based trailing stop is widely used in automated trading systems and expert advisors (EAs) as a reliable stop loss mechanism.

Key Features of the ATR Trailing Stop Indicator

- Dynamic Stop Loss Levels: The indicator adjusts stop loss levels based on market volatility.

- Trend and Volatility Insights: Traders can gauge market direction and the strength of trends using the ATR.

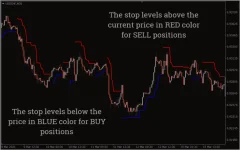

- Color-Coded Signals:

- Red Line: Indicates trailing stop levels for SELL positions, placed above the current price.

- Blue Line: Indicates trailing stop levels for BUY positions, placed below the current price.

- User-Friendly for All Traders:

- New traders benefit from simplified volatility snapshots.

- Experienced traders use it for advanced strategies and refining trailing stop settings.

How to Use the ATR Trailing Stop Indicator

Identifying Trends and Adjusting Stops

- For Buy Positions:

Enter a trade when the indicator changes to blue. Continue holding the position until the line turns red, signaling an opposite trend. - For Sell Positions:

Enter a trade when the indicator changes to red. Exit when it turns blue, indicating a trend reversal.

Entry and Exit Points

The ATR Trailing Stop Indicator is particularly effective in identifying optimal entry and exit points.- Entry: Buy when the line turns blue; sell when it turns red.

- Exit: Let the indicator guide trailing stops to accommodate volatility while protecting gains.

Best Practices

- Combine the ATR Trailing Stop Indicator with other technical tools, such as moving averages, RSI, or price action, to confirm signals.

- Experiment with multiplier settings and indicator parameters to suit specific currency pairs, as volatility varies across pairs.

Chart Example: ATR Trailing Stop in Action

In the GBPJPY H1 chart example:- Red Line: Trailing stop levels above the price signal a downtrend. Traders holding a sell position can follow these levels to lock in profits until the trend reverses.

- Blue Line: Trailing stop levels below the price signal an uptrend. Buy positions can be held confidently until the color changes to red.

Conclusion

The ATR Trailing Stop Indicator for MT4 is a must-have tool for forex traders, providing dynamic stop loss levels tailored to market volatility. By combining it with other technical strategies and refining its settings, traders can maximize their performance across currency pairs and timeframes.For new traders, the indicator simplifies the process of managing volatility and setting stop losses. For experienced traders, it’s a reliable tool to refine trailing stops, identify trends, and enhance risk management strategies.