- Joined

- Nov 2, 2024

- Messages

- 144

- Reaction score

- 5

- Points

- 18

All-in-One Order Blocks Indicator for MT4/MT5

The All-in-One Order Blocks Indicator for MT4/MT5 is a powerful tool designed to help traders identify key areas of interest in the forex market by marking unmitigated, mitigated, and breaker order blocks directly on the chart.

By highlighting these critical zones, the indicator provides a clear view of potential reversal and continuation levels, making it easier for traders to spot key market points for making informed decisions. Each order block is displayed as a colored rectangular area with labels, providing a quick visual reference to key market levels.

This indicator is completely free, with no restrictions, created by fxssi.com. Be sure to explore their other valuable indicators, both free and paid, and support the FXSSI Indicators team!

Order blocks, a concept introduced by the ICT (Inner Circle Trader) community, are similar to traditional support and resistance levels but are derived from price swings. These blocks form around highs and lows of price movements, with traders observing how price reacts to these levels. If the price breaks through an order block, it often retests and continues in the same direction. The Complete Order Blocks Indicator offers an updated approach to chart analysis, making it an effective tool for both beginner and experienced traders.

The All-in-One Order Blocks Indicator is a useful tool for traders looking to incorporate order block analysis into their trading strategy, making it easier to identify key levels and improve trade decisions.

An optional filter can be enabled in the settings to validate order blocks based on the candle’s direction: bearish candles for lows and bullish candles for highs.

Practical Applications for Traders

Order blocks are powerful tools for traders, but they are not standalone signals. They are best used in conjunction with other indicators and strategies for confirmation. Below is a breakdown of how each type of order block can be applied in trading, similar to traditional support and resistance zones:

The All-in-One Order Blocks Indicator for MT4/MT5 is a powerful tool designed to help traders identify key areas of interest in the forex market by marking unmitigated, mitigated, and breaker order blocks directly on the chart.

By highlighting these critical zones, the indicator provides a clear view of potential reversal and continuation levels, making it easier for traders to spot key market points for making informed decisions. Each order block is displayed as a colored rectangular area with labels, providing a quick visual reference to key market levels.

This indicator is completely free, with no restrictions, created by fxssi.com. Be sure to explore their other valuable indicators, both free and paid, and support the FXSSI Indicators team!

What are Order Blocks?

Order blocks, a concept introduced by the ICT (Inner Circle Trader) community, are similar to traditional support and resistance levels but are derived from price swings. These blocks form around highs and lows of price movements, with traders observing how price reacts to these levels. If the price breaks through an order block, it often retests and continues in the same direction. The Complete Order Blocks Indicator offers an updated approach to chart analysis, making it an effective tool for both beginner and experienced traders.

Types of Order Blocks in the Indicator

The Complete Order Blocks Indicator categorizes order blocks into three primary types:- Unmitigated Order Blocks: These are untouched zones representing fresh levels of demand or supply, acting as potential support or resistance.

- Mitigated Order Blocks: These zones have experienced some price action but remain relevant for potential reversals. Price has touched, but not fully covered, these blocks.

- Breaker Order Blocks: These are areas where price has fully covered the order block, suggesting a possible trend continuation.

How the All-in-One Order Blocks Indicator Works

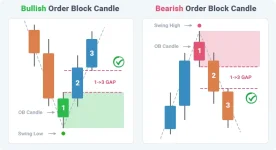

The indicator identifies order block zones by analyzing the height of specific candles, with the order block's height equal to the height of the candle that forms it. The process includes three main steps:- Identify Swing Highs and Lows: Using the ZigZag tool, the indicator detects the highs and lows of price swings. The candle at the top (for highs) or bottom (for lows) of the swing is considered the order block candle.

- Body Comparison: The following candle after the order block candle should have a larger body than the order block candle itself.

- Shadow Check: The wick (shadow) of the third candle after the order block should not touch the wick of the order block candle.

The All-in-One Order Blocks Indicator is a useful tool for traders looking to incorporate order block analysis into their trading strategy, making it easier to identify key levels and improve trade decisions.

An optional filter can be enabled in the settings to validate order blocks based on the candle’s direction: bearish candles for lows and bullish candles for highs.

Practical Applications for Traders

Order blocks are powerful tools for traders, but they are not standalone signals. They are best used in conjunction with other indicators and strategies for confirmation. Below is a breakdown of how each type of order block can be applied in trading, similar to traditional support and resistance zones:

Unmitigated Order Blocks

Strategy: Wait for the price to approach these untouched zones before considering a trade.- Bullish Scenario: The unmitigated order block acts as a potential demand zone. Traders may look for buying opportunities when the price approaches this level.

- Bearish Scenario: The order block serves as a potential supply zone. Traders might consider selling positions when the price nears this level.

Mitigated Order Blocks

Strategy: Look for reversal signals as the price has interacted with this zone but not fully covered it.- Bullish Scenario: This may indicate a support level. Traders could initiate long positions when a reversal signal confirms this zone as support.

- Bearish Scenario: This zone could signal resistance. Traders might consider short positions if reversal signs appear, indicating the price is likely to fall.

Breaker Order Blocks

Strategy: Use these zones to confirm trend continuation after the price has fully covered the order block.- Bullish Scenario: When a breaker order block is present, it suggests that an uptrend may continue. Traders may buy upon a retest of this level, anticipating the price will rise further.

- Bearish Scenario: A breaker order block indicates potential continuation of a downtrend. Traders may sell if the price retests the zone and confirms downward movement.